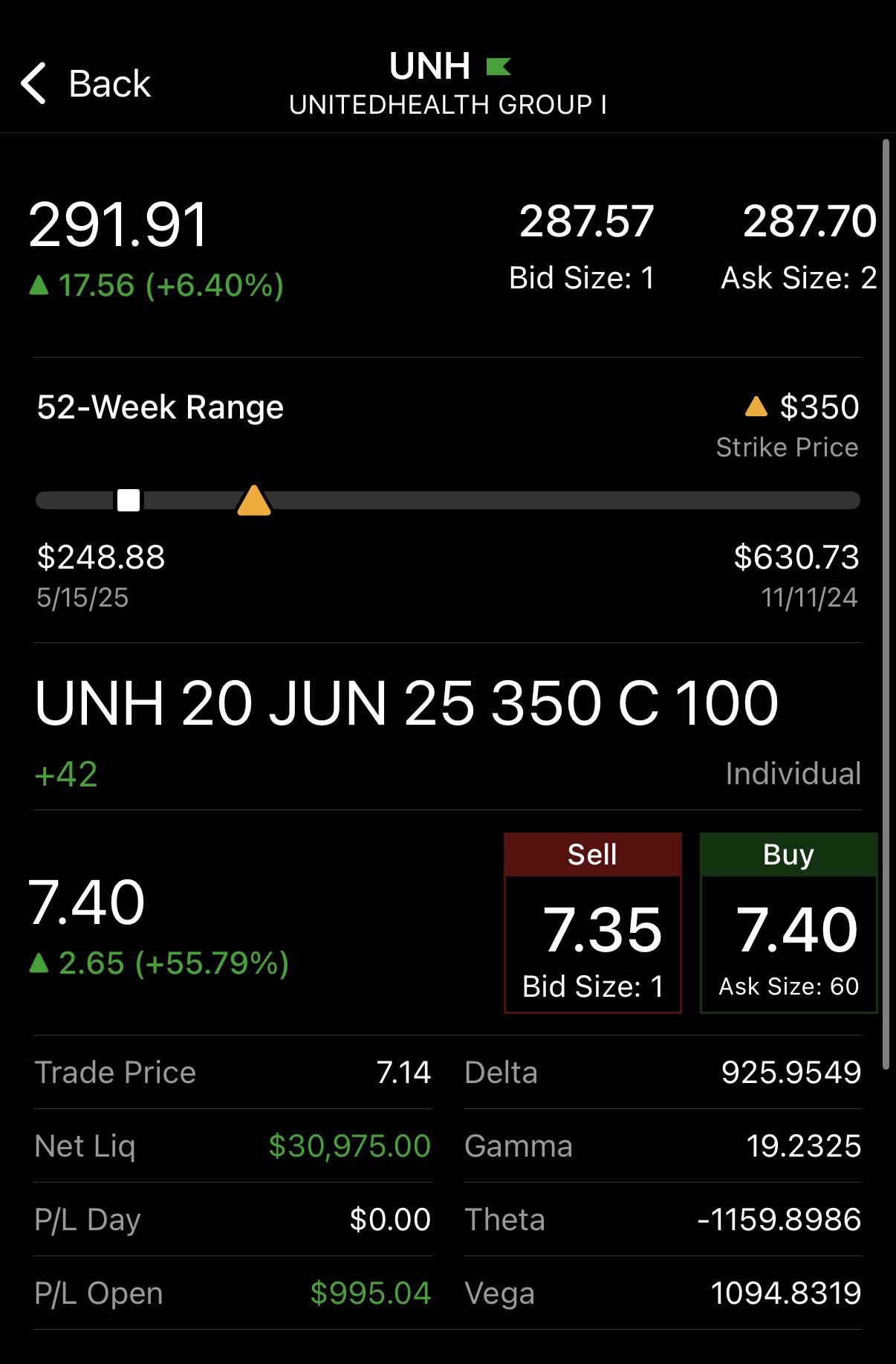

$30K On UNH Calls. Here’s Why The Stock Could Fly:

Despite some people calling me a Permabear after I made a killing after Liberation Day (https://www.reddit.com/r/wallstreetbets/s/fT9ephmvL0) and also shorting BRK.B (https://www.reddit.com/r/wallstreetbets/s/kzUQT0EsA9), I've also had some great success this year being a Bull, most recently with OKLO (https://www.reddit.com/r/wallstreetbets/s/RjAq1SBqSn).

My new favorite trade is also a bullish play: UNH

I have many reasons to be bullish on UNH.

In no particular order:

1. INSIDER BUYING: In the last three trading days, Insiders at UNH have bought $31.6 million worth of shares with $30 million of that coming from the CEO and CFO. Here’s a breakdown of the key transactions:

• Timothy Patrick Flynn (Independent Director) purchased 1,533 shares on May 14, 2025, at $320.80 per share, totaling approximately $491,786.

• Kristen Gil (Director) bought 3,700 shares on May 16, 2025, at $271.17 per share, amounting to about $1,003,290

• John Noseworthy (Director) acquired 300 shares on May 14, 2025, at $312.16 per share, for approximately $93,648

• Additional insider purchases, including significant buys by the CEO (86,700 shares at $288.57 for approximately $25,019,019) and President/CFO (17,175 shares at $291.12 for approximately $4,999,986), were reported on May 16, 2025.

“Show me the incentive and I will show you the outcome.” — Charlie Munger

No better incentive for number go up than Insiders putting more skin in the game to ensure this happens.

2. JIM CRAMER IS BEARISH: Presented without comment (https://x.com/jimcramer/status/1923018153350631806?s=46&t=zA11beG1ZvqVrorBODhs-g)

3. DOJ INVESTIGATION LIKELY A SNOOZE: Fellow redditor u/chrislink73 provided an excellent breakdown for why the DOJ case is pretty weak: https://www.reddit.com/r/ValueInvesting/s/ZO8AUearjn

Furthermore, even if the case isn’t dismissed, it could take many months if not years (factoring in appeals) to resolve. The most likely outcome other than the judge dismissing the case is a settlement where UNH pays a few billion dollars and life moves on. Wall Street Banks have been doing this for years since the GFC and investors just don’t really care.

4. ONE OF AMERICA'S MOST VITAL COMPANIES: UNH is the most important healthcare company in the US. Some stats:

- Covers 50 million people

- $410B in annual revenues

- 400,000 employees

- 90,000 doctors in the network

Said differently: Too Big To Fail.

5. U.S. DEBT DOWNGRADE MAKES UNH A FLIGHT TO SAFETY: Historically, UNH has been a defensive play in times of tumult. Given how oversold it is, UNH could be sought out as a safehaven again, with money coming out of the Nasdaq darlings and into UNH. On the flip side, Moody's and S&P Global already downgraded the US before and we hit ATH anyways. UNH would likely benefit in this scenario as well. Heads I win. Tails I win.

6. V-SHAPED RECOVERIES ARE THE NEW NORM: Go look up charts of the major stock indices during the COVID Crash (March 2020), Silicon Valley Bank Panic (March 2023), Japanese Yen Carry Trade Crash (August 2024), Liberation Day Crash (April 2025). What do all of these crashes have in common? They were short-lived and all had insane V-shaped recoveries. I think the same phenomenon may occur with UNH.

7. GAPS TO FILL: With UNH down over 50% in 1 month, there are some major gaps to fill: $305, $375, $503, $580.

8. FUNDAMENTALS ATTRACTIVE: Wall Street will probably coalesce around EPS of $28 for 2026. If you use a conservative MCO (Managed Care Org.) multiple of 13x, this gets you a PT of $364. I think this is a conservative estimate.

9. BUFFETT BUY POTENTIAL: I have no information to substantiate this but UNH strikes me as the exact type of company Buffett would buy at a sizable discount: Dow Jones Industrial bellwether, Huge competitive moat, systemically important company in the U.S., heavily involved with the insurance business which is what BRK.B specializes in, and massive FCF ($20.71B of FCF in 2024).

10. MEMES GONNA MEME: With soft macro data showing the economy is likely slowing, I believe retail investors are more determined than ever to try to ride the wave of the next meme to outpace any broader economic slowdown whether it be a result of stagflation, job losses, or anything else "out of their control". With large institutions dumping UNH, this is the perfect opportunity for the Regular Joe to accumulate a position in one of the most important companies in America at a massive discount. I think the rocket ship has only just taken off.

I could be wrong about all of this and UNH continues to tank. This is not financial advice. I'm gonna shoot my shot. Good luck out there.