Unusually high option volume

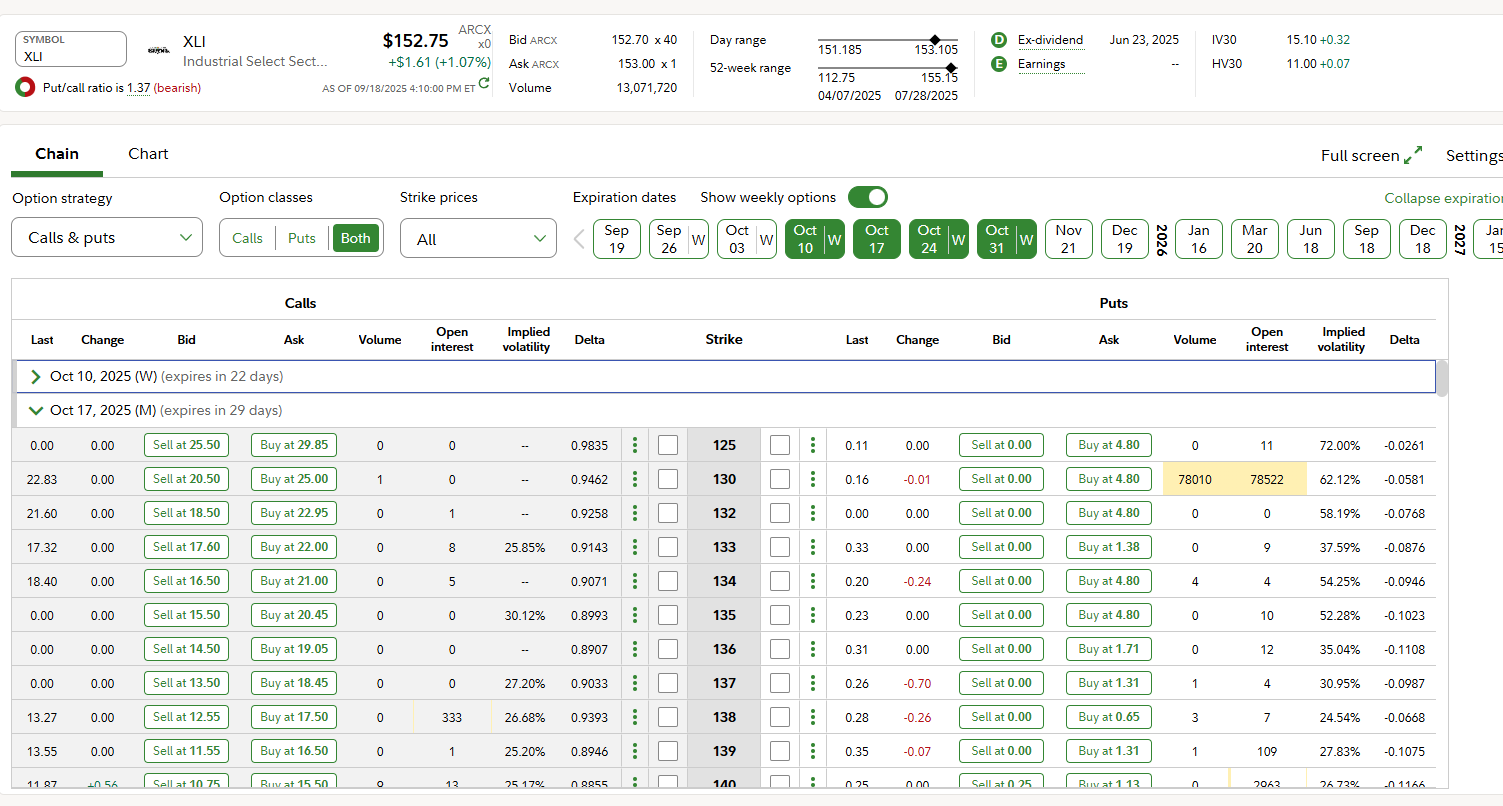

I noticed extremely high options activity on XLI today, for Oct 29th expiration, for the 130, 142, 156, and 161 strike prices. I have some questions related to it.

1. Considering all the other strike prices have such low volume, how could somebody fill these contracts? There are about 250,000 across the 4 strikes, who is on the other side?

2. Based on the greater open interest at the 130 and 142 strikes, and the larger difference from current share price, I'm interpreting this play as a bearish straddle, is this right?

3. Is there a good method to determine if this a hedge against shares owned, or a pure options play?