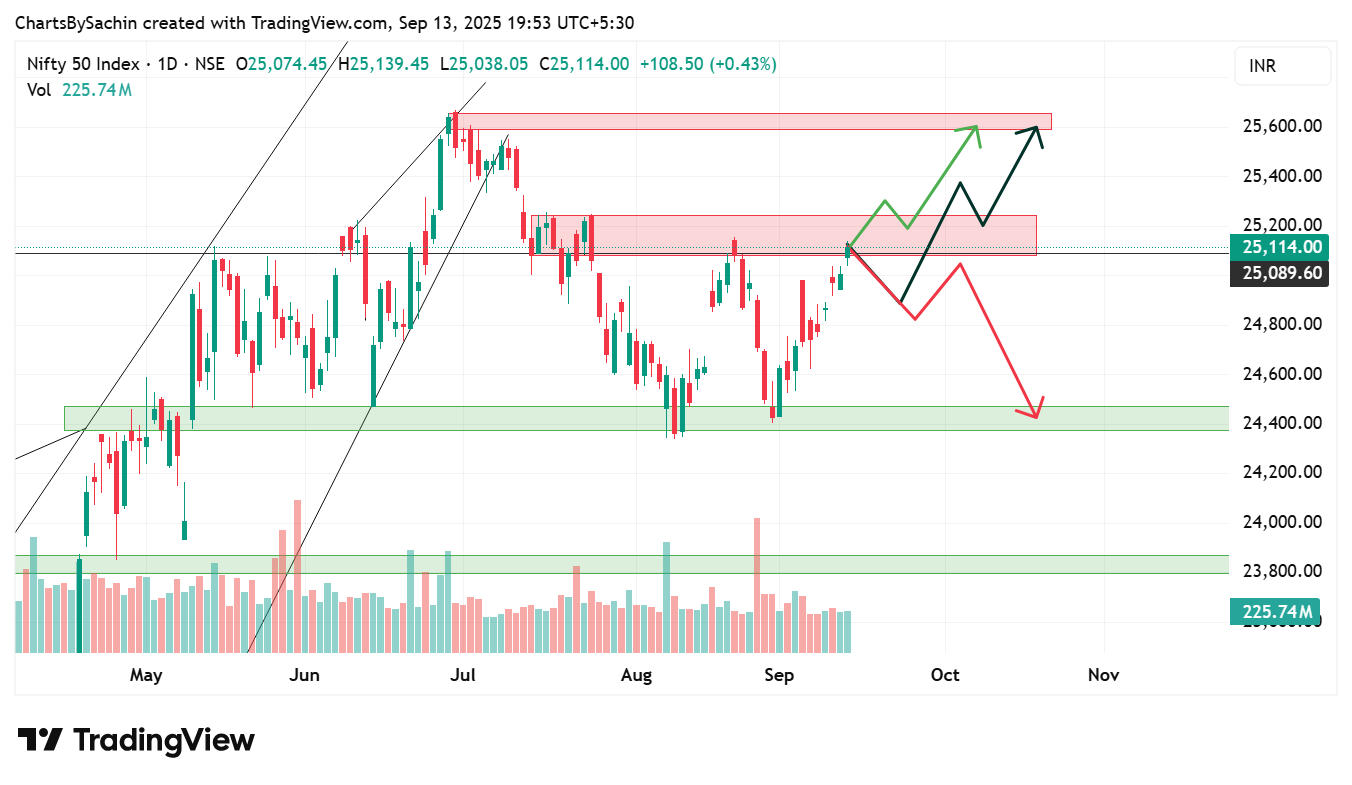

Nifty Eyes 25,500 if Breaks Out; Risk of 24,300 if Rejected

Nifty bounced strongly from the 24,450–23,350 support zone and is now approaching the 25,100–25,250 resistance band. If it sustains above this level, it will confirm a double bottom pattern and open the path toward 25,500–25,600. However, if Nifty faces rejection at this resistance, it may again slip back to test the 24,400–24,300 zone. A retracement before breaking out is also possible, so next week’s price action will be crucial.

🔹 Bullish Case

Nifty bounced from the strong support zone of 24,450–23,350.

Now trading near the 25,100–25,250 resistance zone.

If it sustains above this band, it confirms a double bottom breakout.

Upside targets will be 25,500–25,600 in the short term.

🔹 Bearish Case

If Nifty fails to cross 25,100–25,250 and faces rejection,

Selling pressure may drag it back toward the 24,400–24,300 support zone.

A breakdown below this could extend weakness further.

🔹 Retracement Scenario

Nifty may first retrace a bit lower from current levels,

Then reattempt the breakout above 25,100–25,250 after retesting.

This would be a healthier breakout with stronger follow-through.

✅ Summary: Next week is crucial — a sustained breakout above 25,250 is bullish, while rejection may send Nifty back toward 24,400–24,300. Retracement before breakout is also possible.