Week in Review: Aug 29th +$8.5k

I'm posting this a bit late, but I just wanted to share my previous week’s update.

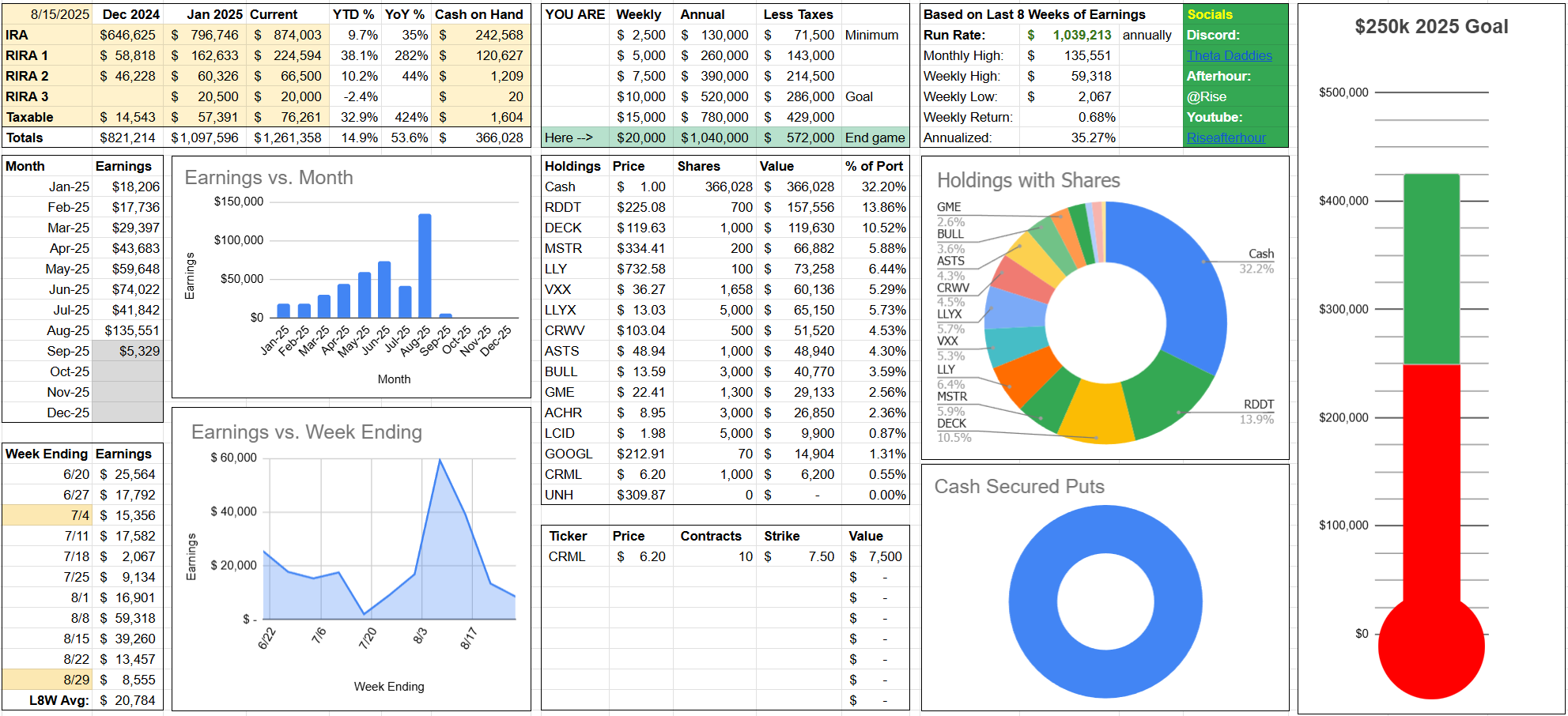

Last week was fairly boring for most of the tickers I follow, with $NVDA earnings dominating the news. I didn't see many obvious opportunities, so I held off on selling covered calls (CCs) for a few positions and just waited. I ended the week at a 0.68% return, which was below my weekly goal, but sometimes it be like that.

# Week Ending / Earnings:

* **07/11:** $17,582

* **07/18:** $2,067

* **07/25:** $9,134

* **08/01:** $16,901

* **08/08:** $59,318

* **08/15:** $39,260

* **08/22:** $13,457

* **08/29:** $8,555

**8-Week Avg:** $20,784

**Run Rate:** $1MM

**Weekly Return:** 0.68%

**YTD Total:** \+$420k

# Returns Analysis:

* Weekly earnings from premiums: +$8,345

* Earnings from shares: +$200

* No booked losses for the week

* 400 $RDDT called away at $225

* 3000 $BULL assigned at $14

# Plays Commentary:

* **$HIMS:** This was a multi-week play. I sold $48C’s below cost basis and got spooked by a run-up early in the week, so I bought back at 50% and didn’t resell since we dropped after. I’ll wait a few days to see if we get another bounce. Looks like we're hitting a regular line of resistance.

* **$RCAT:** A random swing trade that ended up yielding $200. Even writing this out feels like a walk of shame, but I’ll take the profit.

* **$ASTS:** Last week went from moon to back. I sold $50C ITM, but it dropped towards the end. I’d have preferred shares to be called away for another $1200, putting me closer to a 1% return. Bought these back on Friday for a 97% profit, sold them again for next week.

* **$RDDT:** The big winner last week. About half of all premiums came from $200k deployed. Shares barely got called away at $225.08, which is fine. I plan to get back in on Tuesday, possibly after a drop. Will probably sell CSPs and buy some shares here.

* **$GOOGL:** Doesn’t want me to own them. I keep selling ATM CSPs every week, and people keep paying me 1%. Simple but effective. These expire regularly, especially since it’s a pain in my Vanguard account.

* **$BULL:** Earnings looked good but then looked like they looked. Got assigned more shares at $14, which is fine by me. If it drops to $12’s, I’ll add 3k more shares and bring the cost basis down further.

* **$MSTR:** Bought back some October CCs below cost basis, worked out nicely with 50% in premium. Below cost basis, but premiums are still good.

# Non-Theta Plays:

* **$TTD** $50c 6/2026 x5 from a few weeks ago, up 10-20%

* **$MRK** $80c 6/2026 cheap leaps value play

**Next Week’s Thoughts:**

Next week should hopefully be more normal. But what does "normal" even mean? I guess it means volatility coming back. I’m still hedging a small position with VXX, and maybe next week things will get back to being nuts.

We’ve got plays already in the works, like ASTS & CRWV, but there are plenty of opportunities to resell, as mentioned above. Should be a good week!