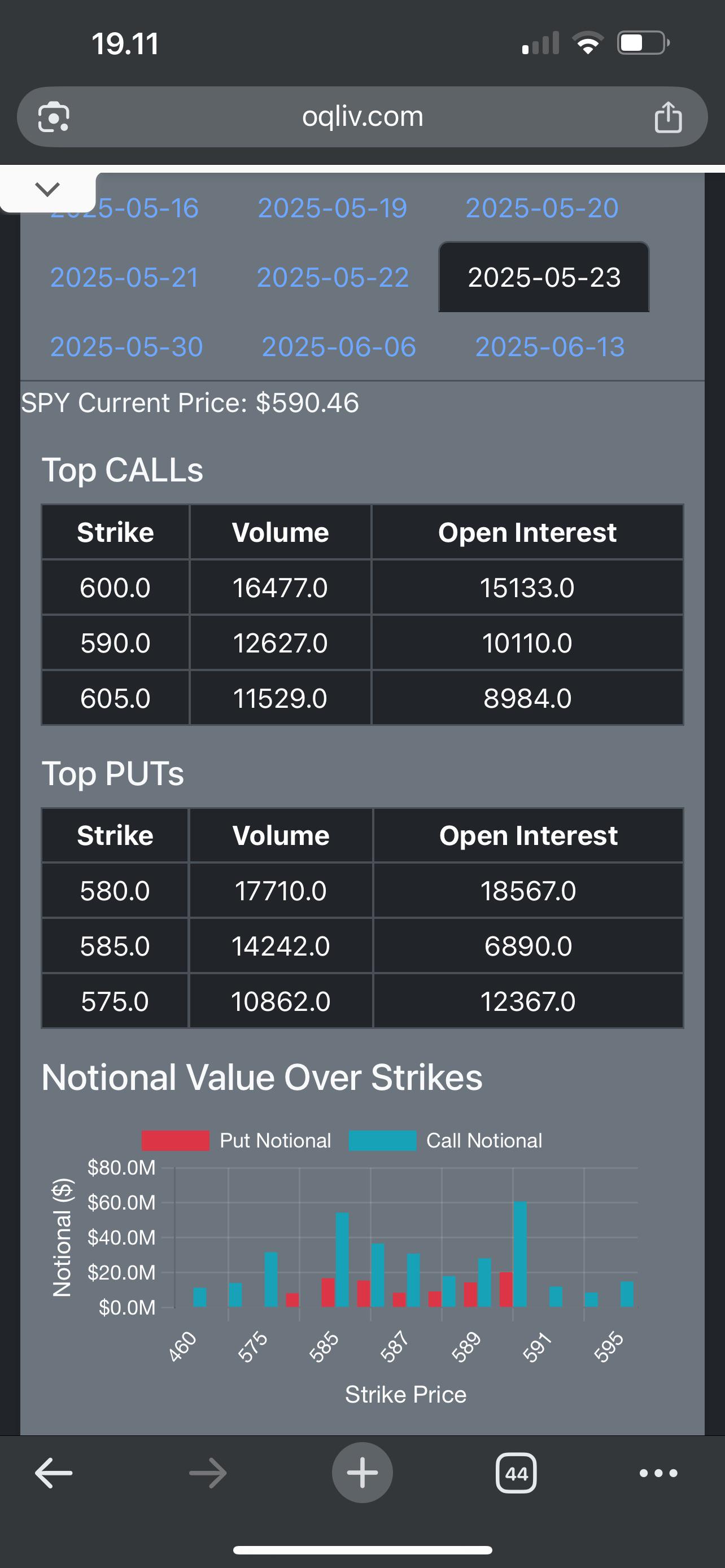

SPY May 23 Options Flow Highlights: Key Levels Forming at $580–$600

SPY is currently trading at $590.46, and May 23 flow shows both bullish and bearish pressure building — great for range traders and breakout watchers.

⸻

Top CALL Clusters:

• $600C: 16.4K vol | 15.1K OI → strong resistance wall

• $590C: 12.6K vol | 10.1K OI → price magnet/short-term pin level

• $605C: 11.5K vol | 8.9K OI → breakout bet zone

Top PUT Clusters:

• $580P: 17.7K vol | 18.5K OI → strong support floor

• $585P: 14.2K vol | 6.8K OI → mid-level defense

• $575P: 10.8K vol | 12.3K OI → downside hedge anchor

⸻

Flow Takeaway (For Traders):

• $585–$600 is the current battlefield.

• If SPY holds above $585, bulls may push for $595–600 test by Friday.

• A crack below $580, especially with rising put volume, opens the door for a retrace to $575 or lower.

⸻

Trade Ideas:

• Straddle/strangle if you expect a move but unsure of direction.

• Call spreads if leaning bullish toward $595–600.

• Put debit spread if betting on a breakdown through $580.

(Source: www.Oqliv.com — live options flow + strike heatmaps.)