I RILY like this stock

If you haven’t hear about RILY I have some nice R/R info for you. It’s been beaten down hard over the past couple of years, but recent developments suggest a possible turning point that might be flying under the radar.

⸻

🚨 The Backstory: A Fall from Grace

For those unfamiliar, B. Riley Financial is a diversified financial services company based in Los Angeles. Their business spans:

• Investment banking / capital markets

• Wealth and asset management

• Retail liquidation (yes, like when big chains go bust)

• Telecom and consumer products (they own stuff like magicJack and Brookstone)

• Financial consulting, valuation, and restructuring services

They’ve historically made money during distressed cycles, particularly in retail—think liquidating bankrupt chains or advising on restructurings.

But things went south. Massive losses, SEC scrutiny, delayed filings, and dividend cuts rocked the stock. From 2021 to late 2024, RILY dropped like a rock—down over 70% at one point.

⸻

💡 So Why Am I Interested Now?

Starting in 2025, things have started to shift. Here’s what’s changed:

1. 📉 Debt Reduction in a Big Way

Between September 2024 and June 2025, B. Riley has reduced over $600 million in debt. That’s not just a small nibble—it’s a serious deleveraging effort. They raised capital through asset sales and a smart securitization of their brand portfolio.

2. 💰 Profitability (Finally) Is Back

They’re now projecting net income of $125–145 million for the first half of 2025. That’s about $4.08–4.74 EPS, after reporting a $772 million net loss in 2024 due to impairments and writedowns.

It’s a massive swing and implies the business is generating real earnings again.

3. 🔥 Asset Monetization Is Working

They recently closed a $236 million asset securitization deal around their consumer brand holdings (like bebe and Brookstone), which is going directly to debt paydown.

They also sold off Atlantic Coast Recycling and GlassRatner, adding another $187 million to their balance sheet.

4. 📈 B. Riley Securities Carve-Out = Hidden Gem?

This is getting almost no coverage, but in Q2 2025, B. Riley Securities (their capital markets business) was carved out. It’s now a standalone unit with $60.9 million revenue and $12.5 million net income last quarter.

It has $94.5 million in cash, zero debt, and just paid a $0.22 one-time dividend. This segment alone could be worth serious value if they unlock it properly or take it public.

5. 🏗️ Leaner, More Focused Strategy

They’re cutting non-core units, selling off illiquid investments, and focusing on core capital markets and advisory. If they can keep this up and maintain a cleaner balance sheet, this could be the beginning of a rerating.

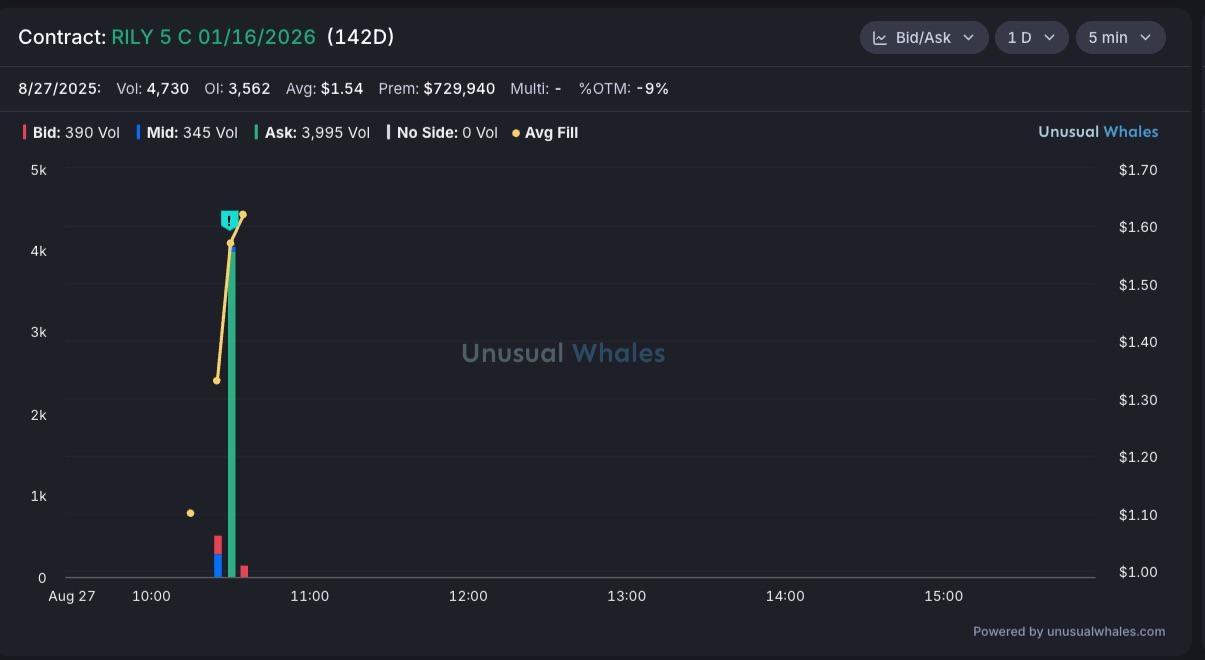

I also wanted to mention a whale (not me) just added $730k worth of call options expiring $5c 1/16/26. With a mcap of only $165 milllion that is a HUGE bet.

TLDR I have calls for $5c 1/16/26 as well as $10c 10/17. It is a stock that isn’t up 500% already like most stocks that are mentioned. Great R/R and an unusual whale buying. 🚀🚀🚀