Analysis of Last Week's Earnings Top Comments and Results

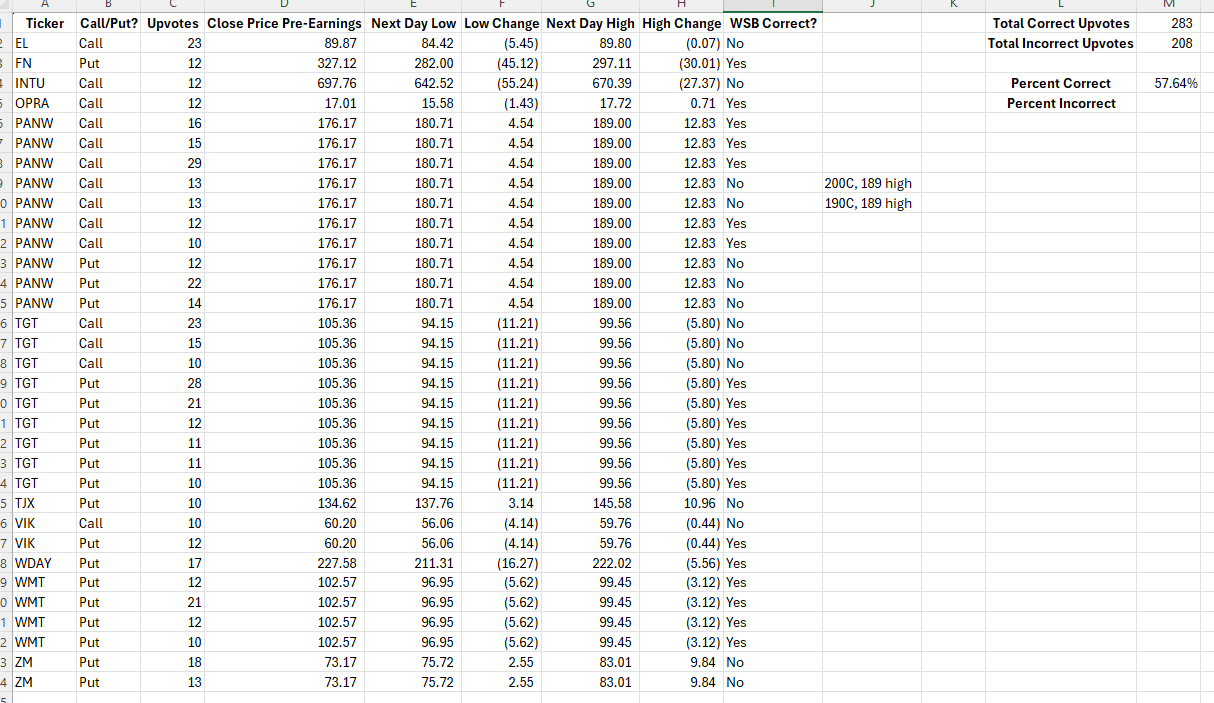

This morning I collected data from last week's earnings post and compiled options plays that got at least 10 upvotes. I compared the closing price of the stock and its movement the next day to see if WSB is good at picking earnings plays or not. The results were mixed.

With top rated comments, WSB has a win rate of 57%, which is positive. However, with a 57% win rate, you better have some damn good risk management, or your portfolio is going to slowly bleed. In addition, this analysis doesn't take options cost or strike price into consideration, so with decent IV, a win on this spreadsheet could actually be a loss; for example, I included two PANW plays which were technically wins because they called them correctly, but a loss because of strike price.

Zoom was the notable, terrible WSB pick. Almost everyone, from highly upvoted comments to comments with only 1-2 votes, picked Zoom to tank. Target was a notable, great WSB pick, as most people picked Puts and it moved significantly, likely making any Put holders profit, even through high IV.

My conclusion: following WSB on earnings is incredibly risky. Besides the low win rate, people tend to pile on to stocks with incredibly high IV and then get crushed after earnings.