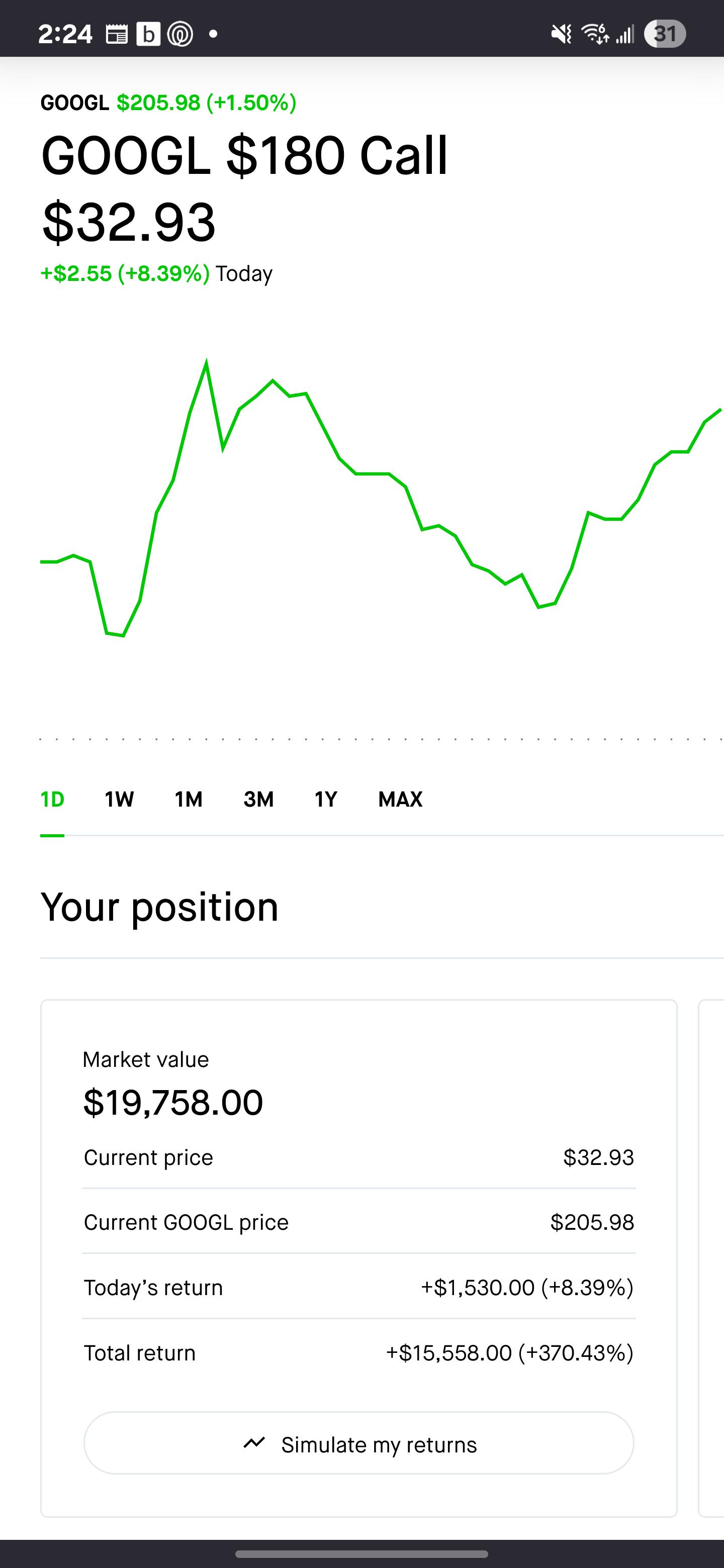

GOOGL 6 month 180C Paid Out

Bought the 180 strike price back when the price of each was 7$ a pop. Sold it today at 33$ each.

Strategy: Think about blue chip companies with really good fundamentals, now at a massive discount vs. their usual highs, and everyone's at most at a panic. The market can definitely drop more but even if it does, how much further could your investment drop? And how high could it go if it rebounds to even half the previous high? Some trades are incredibly +EV but it takes connecting just a few dots:

(1) Current Market Trends - A.I (biggest one)

(2) Biggest players - GOOGL, NVDA, AMD, MSFT

(3) Relative performance - (rank companies)

(4) Fundamentals - balance sheet, debt, earnings etc.

(5) Sentiment Analysis - Monthly, weekly, daily (news, Twitter, other high impact sources with high viewership)

Combine them all into one and you usually get a great trade opening based on just the definitive fundamentals of what is perceived to be valuable. At that point, those 7$ 180C were way too cheap. The upside was easily till 210-220.

If you're someone who trades a similar way using options, in the 6-8 month range (to reduce risk and capture big movements still), let's figure out (maybe we can make a Discord) and actually get some high quality trade ideas going.