+1144% Gain on UNH $300 Put in One Day – A Breakdown of the Setup and Exit

This was one of those textbook plays where timing, volatility, and technicals all lined up.

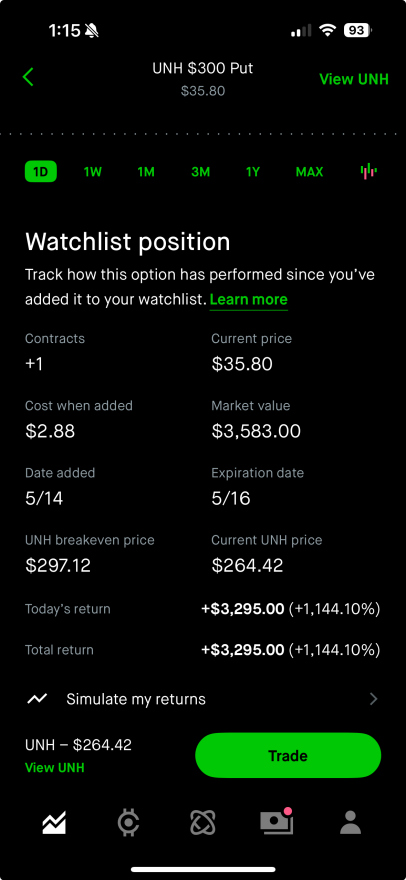

Ticker: UNH

Option: $300 Put expiring 5/16

Entry: 5/14, cost $2.88

Exit (Current Value): 5/15, now worth $35.80

Return: +1144%, or +$3,295 on a single contract

Underlying price move: Dropped from \~$297 to \~$264 in under 24 hours

UNH showed technical weakness on the daily — lost key moving averages, low volume bounce prior week

Market had healthcare under pressure, and this was a pure momentum play.

IV was relatively low when I entered, so I saw potential for both delta move and IV spike.

Break-even was around $297.12, so I knew any meaningful drop would be instantly profitable.

Zero-day or 2-day expiries are incredibly sensitive to price movement and volatility shifts.

Scaling into these positions helps — I went small (1 contract) and let the move play out.

Always have an exit plan. I didn’t expect +1,000% but had alerts set at +300%, +500%, etc.