Downsides to selling CC on a SPAC?

What are the downsides to selling covered calls on a SPAC that I have no intention of holding long-term?

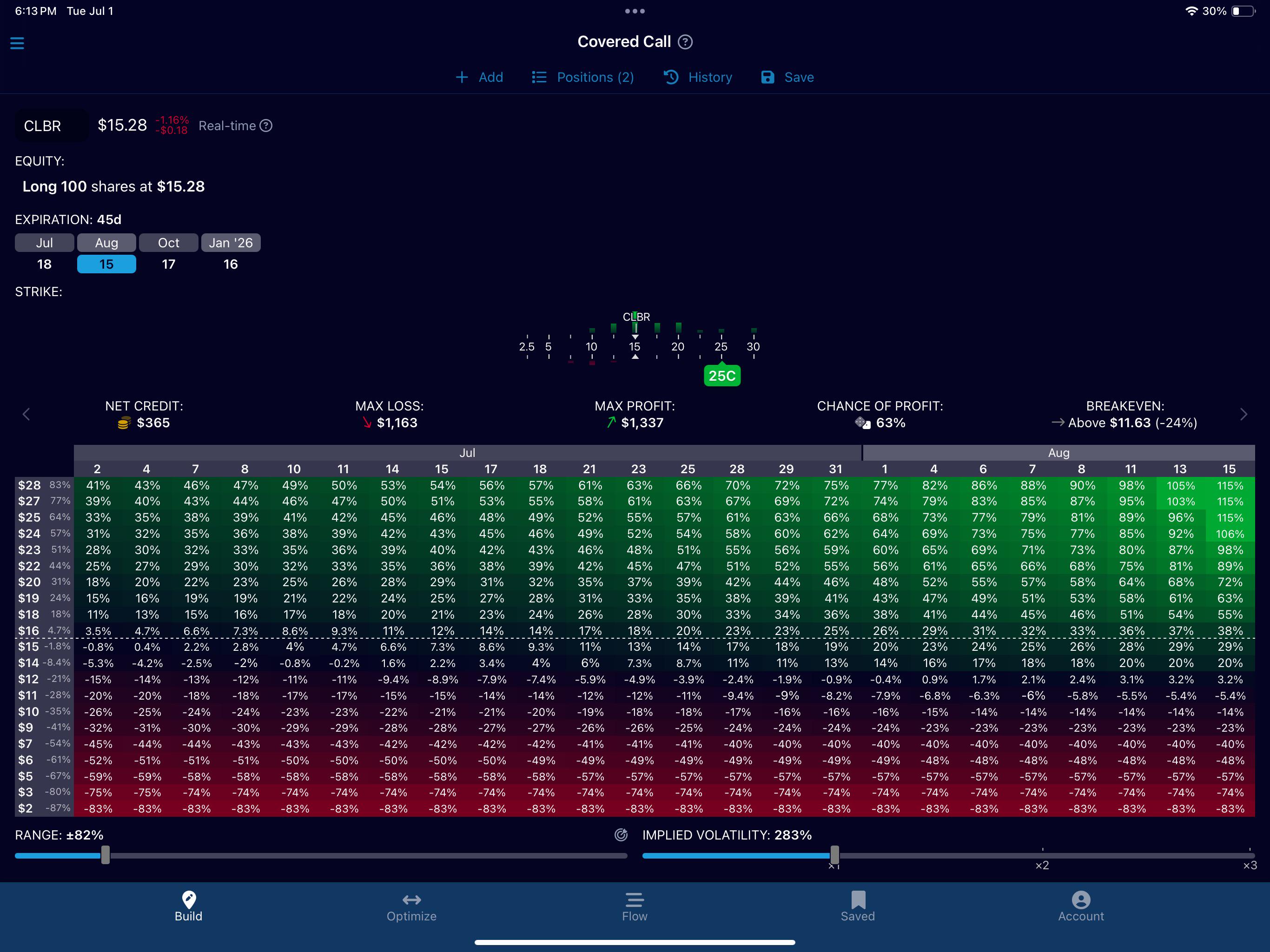

I bought 3600 shares of CLBR at $14 to play the upcoming Grabagun “IPO”. This is just a near-term FOMO play from my perspective, so I don’t mind the shares getting called away if I can get some decent premium and decent price.

Am I looking at this right? A 25C for 8/15 provides a credit of $365 per contract? If the shares were called away, I would essentially net $14.65 per share? ($25 + $3.65 - $14). I understand I would lose out on more profit if the stock runs higher than $28.65.

If CLBR doesn’t pop over $25, the options either expire worthless OR if the IV drops off, I can buy back the option at a much lower price. In either case, I keep the shares.

Is this a dumb idea?