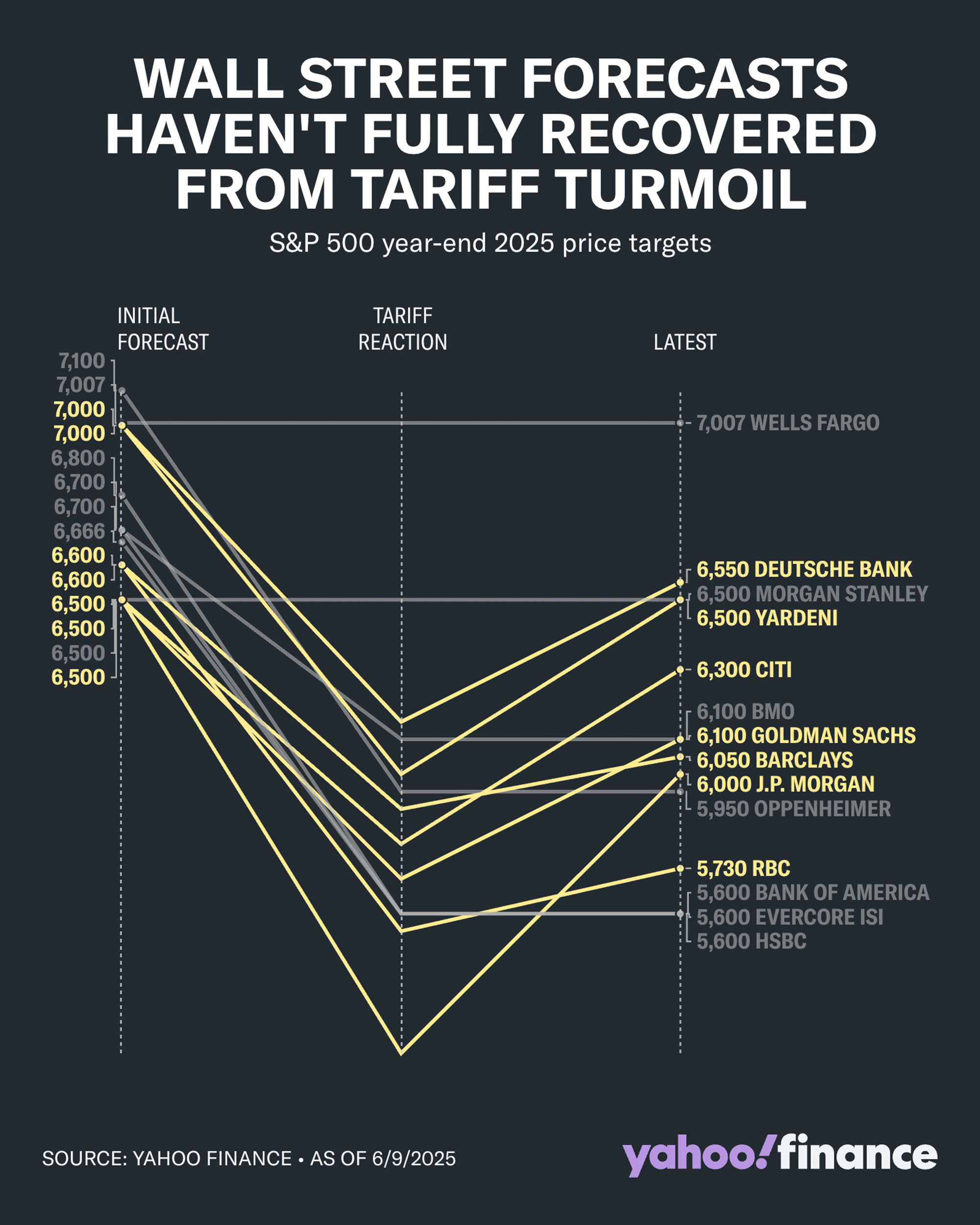

Wall Street forecasts haven't fully recovered from tariff turmoil

[Wall Street strategists aren't scared](https://finance.yahoo.com/news/the-bull-case-for-stocks-is-growing-among-wall-street-strategists-172542612.html) of a summer slowdown for stocks despite some indications of a cooling labor market and [slowing economic activity.](https://finance.yahoo.com/news/us-economy-shows-signs-of-paralysis-as-new-data-reveals-hiring-slowdown-activity-contraction-in-may-133658422.html)

In the past month, several strategists have defended their S&P 500 year-end targets in the range of 6,300 to 6,500, noting that [the most dire outcomes from tariffs may no longer be on the table](https://finance.yahoo.com/news/the-china-tariff-pause-has-wall-street-scaling-back-recession-calls-100054918.html). On Monday, the benchmark index was trading around 6,010, about 2% from the record closing high.

In a note titled "Don't fight it," Morgan Stanley chief investment officer Mike Wilson pointed out that a "moderate slowdown in growth" was likely already priced in earlier this year when the average S&P 500 stock fell nearly 30%.

"In our experience, stocks and equity market internals move well ahead of lagging economic data and earnings results," Wilson said.