Week Recap: It was a short week, but S&P 500 closed at a fresh all-time high once again. Nonfarm Payrolls came in higher than expectations. June 3...

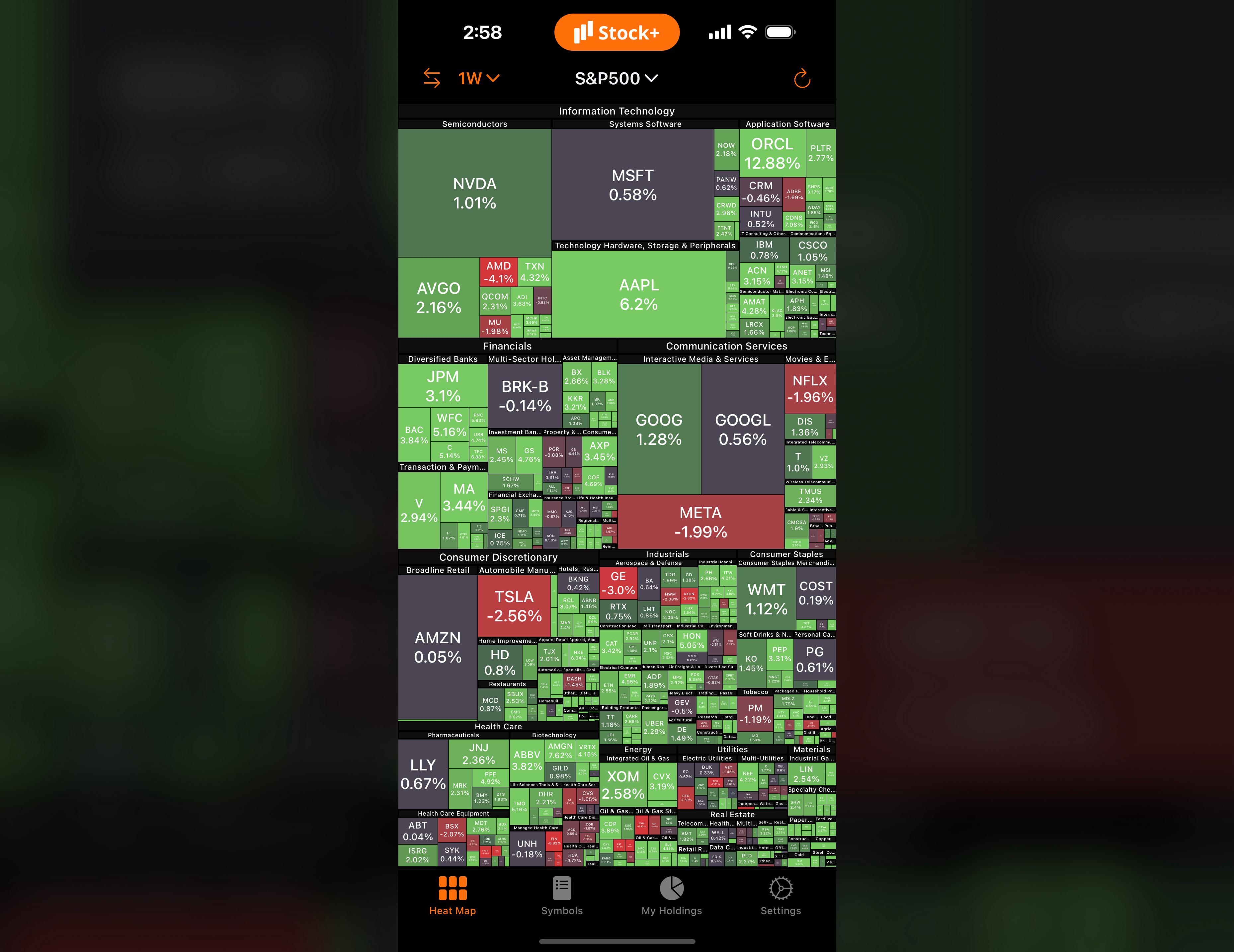

First of all, I don't want to be misunderstood. This heat map is weekly that it visualized via closing prices from June. 27 to July 3.

This week is a short week. It's only three and half working days due to July 4. Despite this, the stock market gained more than 1.5%.

📊 Here are the S&P 500's week-by-week results for the last 4 week,

June 6 close at 6,000.36 - June 13 close at 5,976.97 🔴 (-0.38%)

June 13 close at 5,976.97 - June 20 close at 5,967.84 🔴 (-0.15%)

June 20 close at 5,967.84 - June 27 close at 6,173.07 🟢 (3.44%)

June 27 close at 6,173.07 - July 3 close at 6,279.35 🟢 (1.72%)

🔸 Monday: After a quiet weekend, Monday started slightly higher. During the session, Trump continued to want from Powell urges lower interest rate. Also, EU is close to accept tariffs. As a result, the stock market closed higher around 0.5%. 🟢

🔸 Tuesday: The feud between Trump and Musk continued and Tesla dropped more than 6% at the open. The stock market opened lower. Job Openings increased more than expectations and it gives a bit optimism, but it could not enough for positive side. Also, Senate passed Trump's tax cut bill and the companies could gain multi-trillion dollar costs. As a result, the stock market closed flat, but it's negative. 🔴

🔸 Wednesday: The stock market opened flat again. Tech companies rebounded compared to yesterday and it's helping to lift the Nasdaq. Trump announced that Vietnam will pay U.S. 20% tariff on all goods sent from there into U.S. It's highly related to China because some of China goods is sending through Vietnam and other neighboring countries. The stock market closed higher. 🟢

🔸 Thursday: June Nonfarm Payrolls released higher than expectations. Nonfarm Payrolls data could revision, but it's higher yet. It means that recession risk dropped. Also, the Fed will not cut rate in July. It seems that it could be negative, but the stock market preferred to focus on recession risk. Q1 GDP was negative. Strong Nonfarm Payrolls datas pointed Q2 GDP could be higher. Meanwhile, U.S. Dollar Index jumped back to 97. Thursday was a half-day and closed higher. 🟢

🔸 Friday: Holiday.

No recession, no rate cut and the stock market chose positive news. The S&P 500 completed 2-week winning streak. What do you think? How was your week?

❓ Note: Many people have asked where screenshots come from in my previous posts. I'm using Stock+ on iPhone and iPad. You can find it on the App Store. If you're using Android, I'm now sure if it's available, but you can try searching "Stock Map" or "Heat Map".