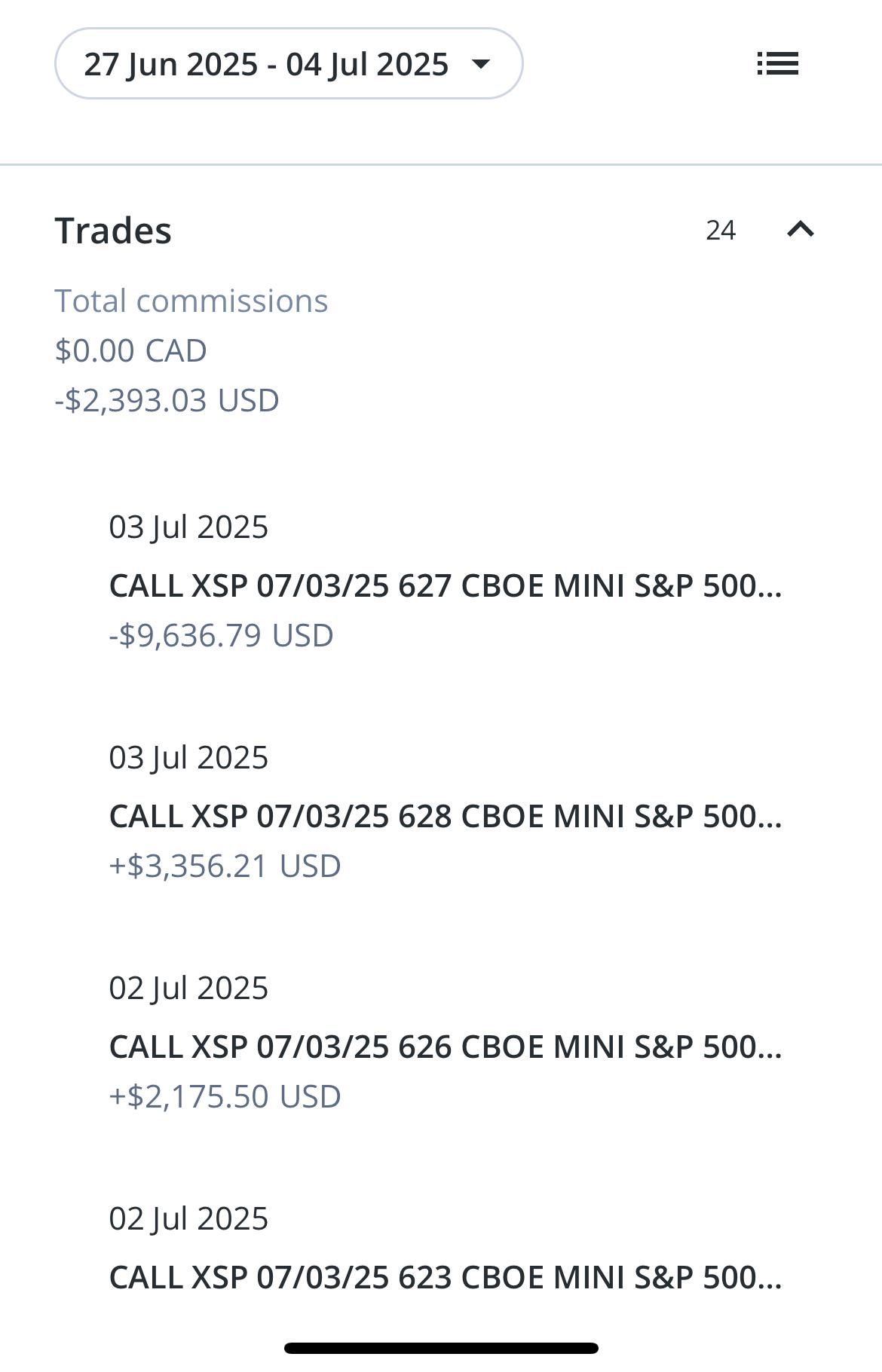

Spent $2400 in commissions to lose $17,000 in a week

Started off with an xsp iron condor on June 27 with a $3,800 credit.

Things went south when I removed the short call leg on July 1 as I was hoping the market would start to rally in the morning.

From then on I did a series of “fixes” that left me at -400 by the end of the day. I was left with two credit spreads.

On July 2, I finally got it right(lucky) and bought back half of the short legs in the morning and then markets went up. Was 50 short and 100 long on the two spreads.

I sold off the long legs when the market was higher and reduced it to 25/25 and 50/50. Was still in the red, so I sold a 150 contract credit spread for 627/628 when the market was around 622 because the market “couldn’t possibly” go up .70% on a half day.

July 3 i watched in dread as the market went up and I scrambled and reduced the 627/628 spread to 29 contracts.

Ended the day -15,500. Dipped into my savings to pay this off.

Alternative realities;

-left the initial iron condor alone loss would be -6600 (or a profit if I had just rolled out the call side.)

-left my 50/100 spreads open the profit would be about 18,000

- didn’t do my revenge trade my loss would be -7500.

- If the 70% tariff comment happened yesterday instead of today I may have walked away with 1000.

Honestly the most ego breaking, confidence shattering moments of my life. This was stupidity and rashness I didn’t know I was capable of. I just had to be right, had to be profitable and couldn’t bear a loss.m. I’ve lost on directional bets before, but only out $400 -$600 at a time.

I pray that I finally learn to not guess when the market is topped out, and will never trade again with just the hope the market goes my way.

I’ll make this back, slowly and with a lot more planning.