RATE ME...

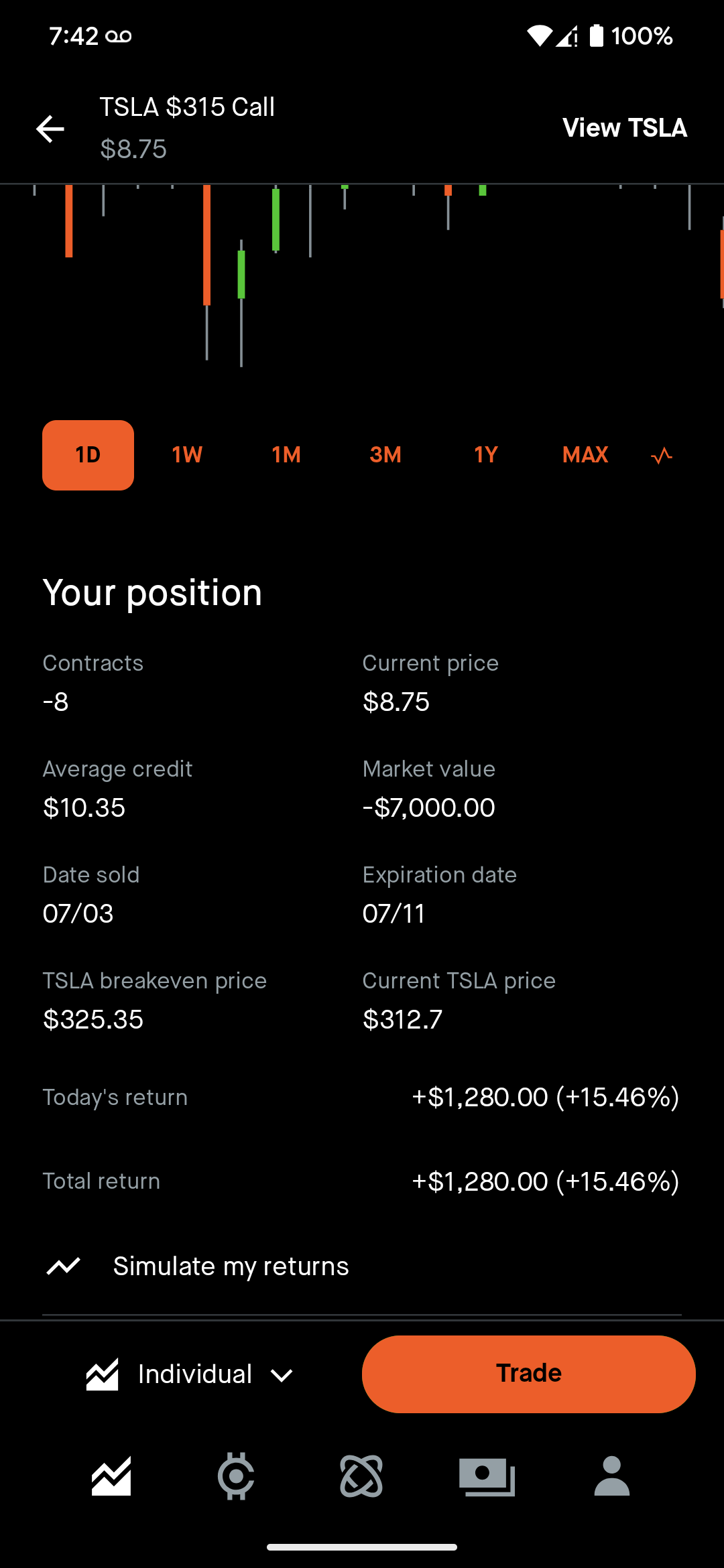

I sold a 310 strike call expiring today and made about 5.7k in premiums. at around 12pm today i had to roll my position for the 1st time because tesla was trading at 317.5 so i was deep in the money. i rolled the position to next week friday at 315 strike and i was paid additional 2k, so my total premiums came up to 7.8k.

I just learned selling near or itm money is quite dangerous, because when i was rolling, robinhood informed me that todays option trading will expire at 1230 pm. When i rolled, i saw for the 1st time Low/medium fill likely hood. its usually high fill likely hood and that really scared me, especially when i only got 30min left.

Theres one point at around 1030pm i believe when tesla was at 313 and i was thinking about buying it back for 2.4k. I couldve still made 3k and end the contract so i can get ready for next weeks big green day to sell another one - which i do think its quite likely since tesla was been bottoming at near 300-320 for a while now while everyone else are at ath.

What would you all have done if u were me?...did i screwed up big or im ok?